India Infoline Finance Ltd. is in the market to raise money up to an amount of up to Rs. 500 crore in the form of NCD (non-convertible debentures).

We will analyze the attractiveness of the India Infoline Finance NCD (IIFL NCD) issue.

You will also understand how to analyze important points that matter for any debenture investment.

The issue opened on 5th September 2012 and closes on 18th September 2012.

Note: This article talks about the September 2012 issue. If you came to this page when you were searching for the IIFL NCD issue in September 2013, you can click here. I still recommend reading the article for the 2012 issue first as the business profile of the company has not changed too much.

Prospectus

Any company that is issuing debentures has to upload its prospectus, a document that contains details of the issue:

- SEBI website

- Go to www.sebi.gov.in

- Click on Offer documents in the menu

- Click on Debt Offer Document

- Click on Final Filed with RoC (the other link is for the draft Prospectus)

- Its own website. In this case India Infoline Finance’s website

- Go to www.iiflfinance.com.

- Click on Investors in the menu

- Click on Offer Documents.

- Agree to the Disclaimer

- Download the prospectus.

Please remember that India Infoline Finance and India Infoline Ltd. which is listed on the exchanges.

What you see on the very first page of the prospectus is the following.

Public Issue by India Infoline Finance Limited, (“Company” or “Issuer”) of Un-Secured Redeemable Non-Convertible Debentures of face value of Rs. 1000 each,

(“NCDs”), aggregating upto Rs. 2,500 million, hereinafter referred to as the “Base Issue” with an option to retain over-subscription upto Rs. 2,500 million aggregating to a total

of upto Rs. 5,000 million, hereinafter referred to as the “Overall Issue size”. The NCDs are in the nature of subordinated debt and will be eligible for Tier II capital.

Unsecured

There are secured and unsecured debentures respectively. An easy analogy is a home loan that you take from a bank. The home is the security. The bank has a secured loan. If you fail to pay the bank on time, the bank can ask you to vacate your home. They will then sell the home (security) and recover their money to the extent possible.

In case of default, secured borrowers have the first right to liquidate the assets the company and take their money back. Unsecured lenders always stand in line after secured lenders. Generally, you should be wary of unsecured lending.

When you buy an unsecured NCD, you are in effect lending your money to the IIFL Finance. There are secured borrowers ahead of this issue of NCDs.

Redeemable

The company will pay back the debentures when the period is over. In other words, it means they want to redeem them.

Non-convertible

Certain debentures are convertible into equity shares of the company.

In IIFL Finance’s case, they are not convertible into equity shares.

Subordinated

Like unsecured lenders come after secured lenders to collect what’s left, subordinated lenders come after all lenders who are not subordinated lenders. Again, if you subscribe to this issue you are behind other lenders who are not subordinated if it comes to the worst case.

Credit Rating

ICRA and CRISIL are credit rating agencies which rate public issues.

ICRA has rated it as AA- (stable).

CRISIL has rated it as AA-/Stable.

If you are not familiar with ratings, know that Government of India bonds are rated AAA which is the best possible rating.

Terms of issue

There are multiple investment options.

| Face value of NCD | 1000 | ||

| Frequency of interest payment | Monthly | Annually | Not applicable |

| Interest rate (%) | 12.75 per annum | 12.75 per annum | Not applicable |

| Effective yield | 13.52% | 12.75% | 12.75% |

| Redemption date | 72 months from date of allotment | ||

| Redemption amount | Rs. 1000 plus accrued interest | Rs. 2054.5 | |

As a general rule, take monthly payments rather than annual payments. A bird in the hand is worth two in the bush. Whatever you get monthly can be re-invested again as you like.

That is why you see effective yield of 13.52% for option one. The assumption here is that you re-invest monthly interest again in an instrument yielding 12.75% per annum. This is more of a theoretical number because you might not get similar yielding instruments over the next six years.

In the last option you receive no interest over the tenure of the bond. You get a lumpsum amount back at end of 72 months (6 years). Effective yield is again 12.75%. Because you invest Rs. 1000/- and get Rs. 2054.5 back at end of 6 years. It effectively works out to investing Rs. 1000/- in an instrument which yields 12.75% per annum and re-investing interest every year again at 12.75% till the end of tenure.

This is particularly risky as compared to the other two options. Theoretically, if there were a default in the third year, then the borrowers under the last option will not have got a single Rupee in the three years. In comparison, borrowers under the first two options will have received some interest income at least.

Summary of business

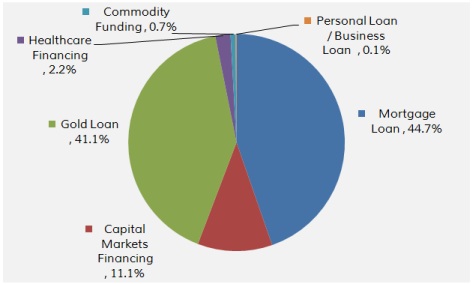

IIFL Finance is in the business of providing financing. They raise funds from banks, private parties, public debenture holders and lend the money onward. The chart below gives a breakup of the loan book as of 31 March 2012 as per the IIFL NCD Prospectus.

Source: Prospectus, IIFL Finance NCD, Capital Orbit

The Prospectus mentions that 99% of the loan book is secured as of 31 Mar 2012. Net non-performing assets (NPAs) are 0.4% of their loan book which is fairly low and a positive point.

Mortgage finance is an area with high competition and an inherently risky business area. The ICRA rating in Prospectus mentions that Loan Against Property and Home Loans make up 89% and 11% respectively of the mortgage part of the loan book.

IIFL Finance is also financing real estate developers. The Prospectus does not carry a breakup of Loan Against Property. I would surely like to know this before I commit money to this issue.

Why is this important?

Because most properties or construction projects cannot be easily liquidated when a customer defaults. Think of a time like 2008 when the economy seemed to have come to a standstill.

A bank or an NBFC might have security on a property when they have given a loan. Security is on paper. To recover money, steps need to be taken to liquidate the asset. There might not be buyers at a good price in the market if real estate slumps.

In this case, the debenture holders bear the risk of a real estate slowdown which can potentially affect close to 40% of the lending book.

The same is the case with gold loans. These make up the next biggest chunk of their business. Gold loans have come under scrutiny by the RBI.

A drop in gold prices can hit the value of the gold and gold jewellery that is pledged by customers.

Banks are increasingly getting active in the gold loan segment. Competition can put further downward pressure on the interest IIFL Finance can charge on gold loans.

I do not find this segment of the business very attractive.

Read a recent article on the gold loan business.

Risk factors

This section in the prospectus is a must read because it is the company’s own declaration of the major risk factors that affect their business.

These are a few risk factors that I felt were particularly important.

Violation of covenant

Our Company has been in violation of the maximum permissible gearing (i.e. Total Debt/ Total Networth) as prescribed under the offer document for issue of Secured Redeemable Non-Convertible Debentures issued on April 20, 2010, during the Financial Year 2011-2012. Our Company’s gearing had grown upto 2.9 times during the FY 2011-12 as against maximum permissible gearing of 2.5 times on a Consolidated and Standalone basis. There is no guarantee that such a violation may not happen again. In the event that there are similar events of default under the terms of offer documents, it can have significant consequences on our business and operations.

In the past this company has violated the covenant (think of it like a promise or commitment with legal binding) in the offer document for another set of debentures they had issued. Gearing means borrowing. They had agreed to a maximum borrowing level in offer document and then exceeded it.

This is not a good precedent at all.

Quality of gold pledged with IIFL Finance

We may not be able to realise the full value of our pledged gold jewellery, due to, among other things, defects in the quality of gold. In the case of a default, we may auction the pledged gold. We cannot assure you that we will be able to auction such pledged gold jewellery at prices sufficient to cover the amounts under default.

This is a risk factor that will be true for most gold loan companies in India.

Liquidity

These debentures will be listed on the exchange. If you want to exit the investment by selling on the exchange be aware that there is low liquidity, a fact which is also pointed out in one of the risk factors.

If you see the link above, you will notice that volumes are not very high in the debt segment.

Taxation

The interest rate return is pre-tax. Tax applicable to interest earned from debentures is as per the tax slab you fall in i.e. 10%, 20%, 30%.

Summary

Look for safety of capital (return of capital) first before you look for return on capital. An extra 2-3% should not make you forget the risks to your principal investment, as a general rule.

IIFL Finance is an NBFC which has lending exposure to areas like mortgages, gold loans and capital market financing which usually are affected first by adverse interest rate or market movements. In a stressed economic scenario with low growth and high inflation I would consider these as high-risk sectors.

The IIFL Finance NCD issue is unsecured in nature, as I mentioned earlier.

I will avoid this issue. Read the disclaimer.

If you found this article useful, share it with others using the sharing icons below. Use the comment box below if there are other points that you want to add or discuss.

If you want to catch all updates on Capital Orbit, sign up for the mailing list.

The post IIFL NCD at 12.75% – Should you invest? appeared first on CAPITAL ORBIT.